Archive for March, 2010

Wednesday, March 31st, 2010

By now you’ve seen plenty of information telling you to stay away from sites like www.creditscorequick.com because you can go to AnnualCreditReport.com once a year and get your credit report online for free, with no obligation.

That is true. You can go to their site and get a copy of your credit report from TransUnion, Equifax, and Experian – and it is free. You don’t have to leave a credit card number, and you don’t have to come back later and cancel if you don’t want further service.

But… and here’s a big but… you won’t get your credit scores. And since most consumers have no idea how the items on their credit report affect their credit scores, all you’ll really know is if there’s a mistake you need to correct.

You’ll also be alerted to signs of identity theft, and that is a big plus.

We at creditscorequick.com decided to see just what annualcreditreport.com really had to offer, so one of our staffers volunteered to go there and get her credit report online. She chose just one vendor and ordered her report.

But before she could access the report, she got a warning that her that the credit report alone wasn’t very useful and that she really should order her credit score before proceeding. If she acted right now, it would be hers for only $7.

She said “no thanks” and went forward. She did get a credit report, and it was nicely done and easy to understand. Before she left the site she was reminded of how important it is to monitor your credit report regularly, and was again urged to buy her scores.

Over the next couple of weeks she received numerous messages urging her to buy her credit scores, and urging her to sign up for credit monitoring, because looking at your credit scores once a year simply isn’t enough for good money management.

If you really do feel comfortable with seeing your credit report just once a year – and not having access to your credit scores – then by all means visit annualcreditreport.com and get your free credit report online.

But if you’d like to know your credit scores as well, choose one of the offers at www.creditscorequick.com . If you don’t want to continue with credit monitoring and regular updates, all you have to do is cancel and you won’t be charged a dime.

Author: Marte Cliff

CreditScoreQuick.com your Credit News Resource.

Posted in Uncategorized | Comments Off

Monday, March 29th, 2010

When Bank of America bought out Countrywide in 2008, party of the package was $25 billion in pay-option adjustable-rate mortgages. When Bank of America bought out Countrywide in 2008, party of the package was $25 billion in pay-option adjustable-rate mortgages.

And because Bank of America fully expected that billions of dollar’s worth of those loans would fail, they paid only $13.9 Billion for them.

A pay-option ARM is an interesting loan product. This is an adjustable-rate mortgage in which the borrower chooses the payment. Under one of the options available to these borrowers, they are actually in a negative amortization situation. While their loan interest might be $1,000 per month, they might choose to pay only $800 – and that extra $200 is simply added to the principal balance of their loan.

Now, in a move designed to keep many of those underwater loans out of foreclosure, Bank of America will be offering debt reduction to approximately 45,000 homeowners. If everyone takes advantage of the offer, the amount forgiven could be as much as $3 billion. Far less than the $11.1 billion

In the case of pay-option arms, Bank of America will supposedly offer forgiveness of some or all of the debt that was added to their loan principal as a result of the monthly unpaid interest. Thus, rather than owing more than the original amount, they’ll be set back to their original loan amount.

Since this may not reduce the payment enough to make the homeowner eligible for a modification under the HAMP guidelines and thus remain in the homes, making payments, Bank of America has another, more complicated plan in mind.

This second stage plan is called “Earned principal forgiveness,” but it isn’t what it sounds like. Under this plan, in which the bank “forbears principal,” the homeowner must owe at least 20% more than the house is worth in the current market.

To begin with, the bank will forbear collecting interest on a portion of the loan amount. If you owe $150,000 but can only afford to make payments on $120,000, they’ll remove the remaining $30,000 from the balance upon which interest is charged. But you will still owe that $30,000.

Then, if you stay current on the loan, each year for the first three years, one-fifth of that forborn amount will be forgiven. One fifth of $30,000 is $6,000 – so in this example you would now owe $144,000 at the end of the first year, $138,000 at the end of the second year, and $132,000 by the time you had stayed current with payments for 3 years.

The plans are complicated, and you cannot make application. But if you have a pay-option ARM, a sub-prime loan, or a prime 2-year ARM that originated with Countrywide, you may get a letter inviting you to participate.

Be sure to read the fine print and understand it thoroughly before you agree.

CreditScorequick.com your resource for credit reports, credit cards, and Credit News.

Posted in Uncategorized | Comments Off

Thursday, March 25th, 2010

Q:

I applied for a credit card with a great rate and my score is in the 700′s on all reports and my income to debt ratio is outstanding. I was denied by Discover because they said that I had too much revolving debt. I was like very astonished so I looked at my Experian report which I supposedly get free anyway. My 210,000 house is paid for and we just built a 1200 square foot pool house. I borrowed 29K on my secured home equity line (second mortgage, which is secured by my home up to $50K. My secured equity line is showing up as and unsecured checking credit line and hurting my ability to get a lower rate card. My additional unsecured debt is 13K. How do I get the 3 credit bureaus to list it as a secured loan or mortgage and not retail unsecured revolving debt. Do I go to the bank and make them re-report it correctly to the credit bureaus or do I go to the bureaus and correct it. Any help would be most appreciated. Thanks, James

A:

Hi James,

I would double check whether your loan with the banks was an actual equity line of credit. Typically banks report this as a mtg payment. If it’s a unsecured line of credit, then it will be reported as such. Let us know what they say. In most cases the bureaus report what the creditor sends them.

CreditScoreQuick.com

Posted in Uncategorized | Comments Off

Monday, March 22nd, 2010

First we had HAMP – the Home Affordable Modification Program. Now we have HAFA, the Home Affordable Foreclosure Alternative Program. First we had HAMP – the Home Affordable Modification Program. Now we have HAFA, the Home Affordable Foreclosure Alternative Program.

When we wrote about it back in February it sounded like it might be a benefit to homeowners in trouble because, among other things:

- No foreclosure could be finalized during the marketing period

- Homeowners would have up to one year to market and sell their homes

- Short sales would be pre-approved, which might lead to faster closings

- No deficiency judgment against homeowners would be allowed

- The homeowner will be given $1,500 to use for moving expense

We mentioned then that the stated goal was to simply the short sale and deed-in-lieu procedures, but that the “simple” guidelines were outlined in a 43 page document. That should have been a warning!

One statement taken directly from the 43 page document says:

https://www.hmpadmin.com/portal/docs/hamp_servicer/sd0909.pdf

- Complements HAMP by providing viable alternatives for borrowers who are HAMP eligible.

- Utilizes borrower financial and hardship information collected in conjunction with HAMP, eliminating the need for additional eligibility analysis.

Why, if the homeowner made application and was eligible for a loan modification, did he not get that loan modification? Obviously they were trying to keep their homes. Under HAFA they’ll either sell short or turn it back to the lender with a deed in lieu of foreclosure.

In order to qualify for HAFA the borrower must be in default or in danger of being in default soon, but to qualify, the lender may require him to make payments, up to 31% of his income. Isn’t that how much he would have been required to pay with a loan modification?

While some experts state that the banks do not want to own any more homes, their behavior in granting (not granting) loan modifications makes that statement questionable.

Another strange provision of HAFA says that the homeowner must transfer clear title.

The lender will allow up to 3 percent of each second loan or lien, up to $3,000 in total, to help the homeowner satisfy these obligations. That seems a bit unclear – but it appears to mean that the homeowner will have to pay off any second mortgage or negotiate with that second mortgage holder to accept a minimum amount in exchange for a full release.

Under HAFA the loan servicer will be required to get an independent appraisal of the value of the house. The borrower will not be charged for this unless the short sale or deed-in-lieu is not completed. Should that happen, the cost of the appraisal will be added to the balance due on the home loan.

Of course, use of the HAFA program will have a negative impact on the homeowner’s credit scores. How that will compare to the effect of foreclosure is yet to be seen.

Author: Marte Cliff

CreditScoreQuick.com your resource for credit reports, credit cards and ground breaking credit news.

Posted in Uncategorized | Comments Off

Friday, March 19th, 2010

Talk about the 2010 Census has a lot of people riled up. Some Internet rabble-rousers have been declaring that this census is the longest and most intrusive of any we’ve ever had – and instructing people to shut the door in census takers faces. Talk about the 2010 Census has a lot of people riled up. Some Internet rabble-rousers have been declaring that this census is the longest and most intrusive of any we’ve ever had – and instructing people to shut the door in census takers faces.

The truth of the matter is this year’s census asks only 10 questions. These are basic questions about population and they do not ask for your financial information nor your Social Security number.

Despite the truth, the news articles and hype surrounding this census have many citizens believing that they will be asked for personal information. And some – especially senior citizens – will feel it their patriotic duty to answer those questions.

And that is where the fraudsters see their opportunity. These crooks, bent on both identity theft and cash theft are posing as legitimate census takers and collecting information and cash from unwitting citizens.

You could be contacted in person, by phone, by postal mail, or by e-mail.

Be aware that there are no official emails going out from the Census Bureau. Anything you get that claims to be from the Census Bureau is an attempt at identity theft.

But that doesn’t stop these crooks from trying. Since bogus email senders can strike and be gone quickly, they aren’t afraid to contact hundreds of thousands of citizens in an attempt to gain information.

Generally, these e-mails say you didn’t fill out the form correctly, then ask for your bank account information, your Social Security number, or even your computer user name and password. (It takes a lot of nerve to ask for that!)

You could also receive a bogus form in the mail. If it asks for personal financial information it’s a fraud… toss it!

If they call on the phone and ask for such information they’re also crooks, even though their caller ID may be set to read “US Census.” Just remember, a legitimate census worker will not ask for your financial information.

Census takers could also show up at the door, and they may ask for personal information or for money – which is illegal. Get their ID and name and report them.

These could be actual paid census takers who have seen the opportunity to make some money on the side. The Census Bureau does screen employees, but they now know that a few identity thieves who have no criminal record are now operating under the protection of their Census Taker status.

Be careful. Don’t give out personal information – ever.

Author: Marte Cliff

CreditScoreQuick.com your resource for ground breaking Credit News.

Posted in Uncategorized | Comments Off

Thursday, March 18th, 2010

February 22 marked the effective date of the Credit CARD Act of 2009 – bringing relief to consumers who will no longer be subjected to practices such as increasing interest rates on existing balances and reducing credit lines to less than the balance owed. February 22 marked the effective date of the Credit CARD Act of 2009 – bringing relief to consumers who will no longer be subjected to practices such as increasing interest rates on existing balances and reducing credit lines to less than the balance owed.

The Act, while not covering all credit card abuses, is good news for consumers struggling to keep up with mounting debt during the economic crisis.

But there’s one thing we didn’t hear about while learning the many benefits of the new law: it doesn’t apply to business credit cards.

This can come as a surprise to many of us who never stopped to consider the difference between a personal credit card and a business credit card. Aside from keeping expenses separated for accounting purposes and the fact that the rewards might be different, we probably viewed a business card the same as any other. But, as it turns out, they are two separate things, covered by different rules.

Credit card issuers may choose to extend the CARD Act rules to their business credit cards, but they are not obligated to do so. Thus, the interest rate on the balance you carry on your business credit card can still be increased for any reason.

To avoid this threat some small businesses are transferring business debt to their consumer credit cards, but experts say that is not a good idea. For one thing, using a consumer card for business could turn it into a business card under the law.

Next, using a consumer card for business expenses can lose the tax deductions allowed for interest on business expense. Any time you mix business and personal expenses on the same card, it becomes difficult to calculate interest paid on each, so the IRS will disallow all interest deductions for that card.

This use can also lower your FICO credit scores because business debt will be reported as personal debt. Until recently, no business debt was reported to the credit bureaus. Capital One has recently changed their methods and does now report small business credit use to both business and consumer credit bureaus.

Finally, financial advisors are warning that small businesses should act quickly to create a back-up plan for business expenses. If possible, obtain a fixed rate small business loan to cover any outstanding business credit card debt.

Since the CARD Act prevents credit card issuers from imposing penalty rate increases on consumers, they will be losing a revenue source of approximately $10 billion per year. Experts expect that they will attempt to regain some of that loss through rate and penalty increases on small business credit cards.

Author: Mike Clover

CreditScoreQuick.com your resource for credit report, credit cards, loans and Credit News.

Posted in Uncategorized | Comments Off

Saturday, March 13th, 2010

Hearings before the House Financial Services Committee could spell changes for FHA loan guidelines this year. Hearings before the House Financial Services Committee could spell changes for FHA loan guidelines this year.

Testimony centers around proposals to raise the minimum down payment from 3.5% to 5% – and to 10% for borrowers with credit scores of 500-579. Borrowers with scores below 500 would be ineligible.

Some, citing the danger of inflated appraisals, also wish to lower a sellers’ maximum contribution to buyer’s closing costs from 6% to 3%. Mr. Charles McMillan, representing the National Association of Realtors, warned that such a move could cause a severe drop in home sales in areas of the country where home prices and closing costs are high.

Mr. McMillian also argued that credit scores are not a perfect indicator of the ability to repay a loan, and that raising the down payment to 10% for borrowers with scores below 580 will negate the intent of FHA financing – which is to serve those under-served by the private market

FHA Commissioner David H. Stevens, in an 18-page prepared speech, warned that raising the required down payment could seriously impact recovery of the housing market. According to an agency evaluation of recent loans, raising the down payment requirement would reduce the number of FHA loans by 40%.

Thus 300,000 buyers – the majority of whom were first time buyers, Hispanics, and African Americans – would not have received mortgage loans.

Instead of raising the down payment for borrowers with a minimum 580 FICO score, FHA now proposes to lower the up-front FHA mortgage insurance and increase the annual premium, which is paid monthly. At present, the up-front mortgage insurance premium is at 2.25% of the loan value and is financed into the loan balance.

This move would change the loan to value ratios, but would mean little to borrowers as they make their monthly payments – the mortgage insurance will still be an additional cost over the principal, interest, taxes and insurance included in their monthly payments.

The proposed changes are an effort to reduce risk while increasing revenues for FHA. Due to the recent mortgage crisis, FHA secondary reserves have fallen below the required 2% level. Stevens noted, however, that FHA has not been hit with the delinquencies and foreclosures that have plagued the subprime market. This is due to the fact that throughout the housing boom and the era of easy loans, FHA maintained loan standards such as requiring verification of borrower income and employment.

Eight individuals, representing various sectors of the real estate industry, presented their prepared comments – many of them conflicting and at least one citing record-keeping errors that skew the results of FHA evaluations. To read their remarks, go to http://www.house.gov/apps/list/hearing/financialsvcs_dem/hrhousing_030410.shtml

Author: Mike Clover

CreditScoreQuick.com your resource for Credit News.

Posted in Uncategorized | Comments Off

Friday, March 12th, 2010

The Credit CARD Act of 2009 is now in effect, so if you’re living on a college campus you’ve probably noticed something missing. The Credit CARD Act of 2009 is now in effect, so if you’re living on a college campus you’ve probably noticed something missing.

You’re no longer seeing tables with credit card representatives trying to lure you into making application for their cards. You’re no longer being offered pizzas, t-shirts, and teddy bears in exchange for your signature on the dotted line.

That’s because the credit card companies are no longer allowed to use these enticements – and many economists see that as a good thing.

The era of easy credit for college students has led to an average credit card debt for college students of more than $3,000. That might not seem like much for an adult earning a good income, but for a college student who is not yet earning income, it’s a hefty sum.

Some financial experts believe that lack of access to credit will force college students to budget and make wise spending choices – a good way to enter adulthood by anyone’s estimation.

But still, life does sometimes present us with emergencies, and sometimes fast credit is the only way to deal with them. What do you do if your bank account is hovering near empty, you need to drive 20 miles to class each day, and the transmission on your clunker gives out?

Having a credit card in your pocket for emergencies is a secure feeling.

So how can you get a credit card if you’re a student, under 21 years old, and you missed the February deadline? The most obvious way is to gain employment that would qualify you for your own card. But if you’re dedicated to earning a degree, employment may be out of the question right now.

The next-best way is to get a parent or guardian to co-sign. This is a risky move for them, so handle it carefully. If you use the card wisely and make all the payments on time, their credit scores will be improved. But if you max-out the card or fail to make a payment, you’ll be hurting the person who helped you.

One safeguard for your benefactor is that you won’t be able to increase the credit limit without their permission. So if they agree to co-sign for a $1,000 credit limit, you can’t increase it to $5,000.

Once you turn 21 or gain employment that would enable you to meet the payments on a credit card, you should apply for a new one under your own name. Once you have it, close the joint account and release your family from the obligation.

Author: Mike Clover

CreditScoreQuick.com your resource for credit cards, credit reports, loans and Credit News.

Posted in Uncategorized | Comments Off

Monday, March 8th, 2010

While FICO isn’t giving away all of their secrets, they have now revealed the damage done by a few common credit scenarios. While FICO isn’t giving away all of their secrets, they have now revealed the damage done by a few common credit scenarios.

Unfortunately, in the current economy, these scenarios aren’t so much mistakes as situations/events caused by widespread unemployment and pay cuts.

Interestingly, the “Damage Points” chart shows that the higher your current credit score, the more damage will be done by one of these events.

Topping the list of most damaging to credit scores is bankruptcy. A consumer with credit scores averaging 780 or more can expect scores to drop 220-240 points, while a consumer with scores of 680 will see a drop of only 130-150 points.

Least damaging is a maxed-out credit card, hurting those with 680 scores by only 10 to 30 points, and dropping a 780 score by 25 to 40 points.

Depending upon your initial scores, a 30-day late payment will drop scores from 60 to 110 points, debt settlement will cause a drop of 45 to 125 points, and foreclosure will have an 85 to 160 point effect.

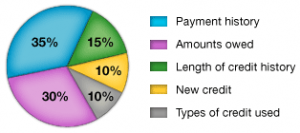

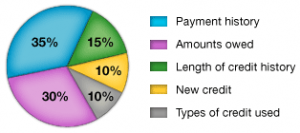

Lenders use these scores to determine your credit worthiness. In general, the higher your scores the greater your chance of getting a loan, and getting a favorable interest rate on that loan. However, credit scores are not the only criteria. Lenders also look at other details, such as your total debt to income, the length of time you’ve been on your job, and the number of dollars you have in savings.

These situations can’t really fall under the category of credit mistakes, but we know there are plenty of mistakes that can affect your credit.

For instance, the report shows the damage if you max out a credit card. What’s the damage if you use 65% of your available credit instead of staying below the recommended 30%? What’s the impact if you let a merchant or a prospective landlord run a credit check on you? How much will it hurt if you get mad at a credit card that’s raised your interest rate – and close that account? How damaging is it to not carry any credit cards?

Since we don’t know the answers to those questions, the best course of action is to use credit, but use it sparingly, and pay all bills on time. If you carry several credit cards, be sure your balances are spread out, showing that you have access to far more credit than you use on each card. And don’t let anyone check your credit until you’re sure you’re ready to make a purchase.

Finally, keep a close eye on your credit report and correct all errors promptly.

Author: Mike Clover

CreditScoreQuick.com your resource for credit reports, credit cards, loans, and Credit News.

Posted in Uncategorized | Comments Off

Monday, March 8th, 2010

Soon consumers who find errors on their credit reports will be able to request corrections directly from the merchant who reported the inaccurate information.

Previously, consumers had to report the error to the credit bureau who included it in their credit report. The credit bureau would then contact the merchant and wait for a response. Unfortunately, the method of contact made resolution difficult for merchants because the credit bureaus use a code number to describe the complaint, rather than an explanation.

This rule change by federal banking regulators was finalized in July 2009 and goes into effect July 1, 2010.

The new rules also require merchants who report information to do so with “integrity.” In this case, integrity means that they must clearly identify you and use a standardized format to convey their information. The information must include the time period to which the information refers and the credit limit on your account.

Reporting credit limits has the potential to raise consumer credit scores in the event that the consumer is using only a small portion of their available credit.

One danger to consumers is that their complaint may be disregarded as “frivolous” unless they comply with reporting requirements. So if you’re a consumer upset over an error on your credit report, don’t get angry and ramble. Instead, use this standard format:

• Provide your full name and your account number.

• Clearly state the reason for our dispute. Give the date of any transaction in dispute and explain the nature of your complaint. For instance, if they have reported a payment as late and you believe it was paid on time.

• Provide documentation to show why the report is incorrect. In the case of a late payment, provide a copy of electronic banking records or your cancelled check. If an account has been paid in full, provide a copy of a final statement as proof.

Once you have provided proper information, the merchant will have 30 days in which to investigate and get back to you. Should they fail to do so, the FTC, state attorneys general or bank regulators could potentially bring a case against them, with civil penalties of up to $3,500 per occurrence.

After an error has been verified and correction has been made, the merchant is required to send a corrected report to the credit bureau.

Considering the amount of data transmitted daily and the ease with which a typographical error can be made or a line in a report skipped, consumers with errors should not take them as a personal affront. Instead, they should take immediate action to correct the error.

The fact that over 70% of all credit reports contain errors is one reason why we believe all consumers should read their own credit reports monthly. Just one 30 day late payment can reduce credit scores from 60 to 110 points – having a serious effect on the consumer’s ability to qualify for good interest rates.

Author: Marte Cliff

CreditScoreQuick.com your resource for credit reports, credit cards, loans and Ground Breaking Credit News.

Posted in Uncategorized | Comments Off

Disclaimer: This information has been compiled and provided by CreditScoreQuick.com as an informational service to the public. While our goal is to provide information that will help consumers to manage their credit and debt, this information should not be considered legal advice. Such advice must be specific to the various circumstances of each person's situation, and the general information provided on these pages should not be used as a substitute for the advice of competent legal counsel.

|

When Bank of America bought out Countrywide in 2008, party of the package was $25 billion in pay-option adjustable-rate mortgages.

When Bank of America bought out Countrywide in 2008, party of the package was $25 billion in pay-option adjustable-rate mortgages. First we had HAMP – the Home Affordable Modification Program. Now we have HAFA, the Home Affordable Foreclosure Alternative Program.

First we had HAMP – the Home Affordable Modification Program. Now we have HAFA, the Home Affordable Foreclosure Alternative Program. Talk about the 2010 Census has a lot of people riled up. Some Internet rabble-rousers have been declaring that this census is the longest and most intrusive of any we’ve ever had – and instructing people to shut the door in census takers faces.

Talk about the 2010 Census has a lot of people riled up. Some Internet rabble-rousers have been declaring that this census is the longest and most intrusive of any we’ve ever had – and instructing people to shut the door in census takers faces. February 22 marked the effective date of the Credit CARD Act of 2009 – bringing relief to consumers who will no longer be subjected to practices such as increasing interest rates on existing balances and reducing credit lines to less than the balance owed.

February 22 marked the effective date of the Credit CARD Act of 2009 – bringing relief to consumers who will no longer be subjected to practices such as increasing interest rates on existing balances and reducing credit lines to less than the balance owed. Hearings before the House Financial Services Committee could spell changes for FHA loan guidelines this year.

Hearings before the House Financial Services Committee could spell changes for FHA loan guidelines this year. The Credit CARD Act of 2009 is now in effect, so if you’re living on a college campus you’ve probably noticed something missing.

The Credit CARD Act of 2009 is now in effect, so if you’re living on a college campus you’ve probably noticed something missing. While FICO isn’t giving away all of their secrets, they have now revealed the damage done by a few common credit scenarios.

While FICO isn’t giving away all of their secrets, they have now revealed the damage done by a few common credit scenarios.