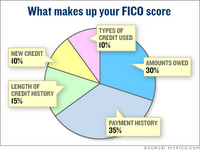

Fico scores are calculated from different data within your credit report. This information is grouped into five categories. The Chart below will reflect this as well as the percentage of importance for each category.

These percentages of these categories are for the purpose of the general population. For example someone that is new to the credit scène these percentages may not apply.

Payment History

• Number of accounts paid as agreed

• Presence of negative Public Records(Judgments, bankruptcy, suits, liens, wage attachments, etc ( Collections, and/or delinquency(past due items)

• Severity of delinquency( how long past due)

• Amount past due on delinquent accounts or collection accounts

• How much you’re past due on accounts or collections.

• How many collections you have

• Account payment information on particular accounts (installment loans, credit cards, retail accounts, finance company accounts, car notes, mortgage, etc…)

Length of Credit History

• Time since account activity

• Time since accounts opened

• Time since account opended, by type of account

New Credit

• Time since account was open, by credit type

• Time since credit inquiry

• Number of recently opened accounts, and proportion of accounts recently opened by account type.

• Re-establishment of credit after recent credit problems

• Number of recent credit inquiries

Amounts Owed

• Proportion of installment loans still owed, proportion of balances to original loan amount on certain installment loans

• Number of accounts with balances

• Amounts owed on specific types of accounts

• Amount owed on accounts

• Lack of specific types of credit balances

• Proportion of credit lines used (proportion of balances to total credit limit on certain types of revolving accounts

Types of credit used

• Number of (prevalence, presence, and recent information on ( different account types such as credit cards, retail accounts, mortgage, installment loans, and consumer finance accounts.

*Please take note

Your FICO score takes into consideration of all these variables discussed.

No one piece of information or factor will determine your score alone.

The importance of any factor depends on your over all credit history.

It is really hard to single out any other factor over another, since all factors take part in the overall scoring process. What is important is the mix of information being reported within your credit report.

Your FICO score only looks at information within your credit report. However lenders look at other information outside this report to also make a credit decision.

Example:

• Work History

• Salary

• Rental History

• Kind of credit you are requesting

Your score considers both negative and positive information on your credit report. Late payments will lower your credit score, but establishing or re-establishing a good payment history will increase your credit score.

CreditScoreQuick.com