|

| Home | Credit Help | Credit Cards | Credit Score | Identity Theft | Blog |

Get Your FREE 3 Credit Scores!Starting Your FreeScoresAndMore Trial is as Easy as 1-2-3! |

Free scores based on data from Credit scores are provided by CreditXpert, Inc.

Services Included:

Fact: Checking Your Credit Rating With FreeScoresAndMore Will NOT Lower Your Credit Scores!

|

Credit Help

Tips for Reducing Your Credit Card Debt |

|

3-Bureau Credit Scores Credit Monitoring &Alerts Identity Theft Protection Credit Score Simulator * Your credit scores are provided by CreditXpert, Inc. and indicate your relative credit risk level for educational purposes. They may vary between bureaus and are not the scores used by lenders. Your scores may not be identical or similar to scores you receive directly from credit agencies or other sources. * Daily monitoring will notify you of any new inquiries, certain derogatory information, accounts, public records, or change of address that have been added to your credit reports as reported by any of the three major credit reporting agencies. If no information has been added or changed, then you will receive a monthly notification stating that no information has changed within your credit file. FreeScoresAndMore is a service of Trilegiant Corporation. Any part of the FreeScoresAndMore service may be modified or improved at any time and without prior notice. FreeScoresAndMore is not available to residents of Rhode Island and Iowa. FreeScoresAndMore is a service mark of Affinion Publishing, LLC. What is a Good Credit Score? There are two main credit score models used today. Here are each credit score ranges.

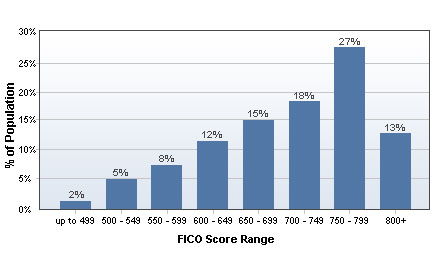

Most lenders use the Fico Score Model when pulling your credit report. The banks trust this algorithm for dictating your credit risk for loans Vantage Score is a model that was introduced by Experian and TransUnion in 2006. This model only has about 6% of the market share. Fair Isaac's FICO Score range by Population.

The following credit score ranges are bracketed by credit score range. These credit score ranges are created by Freddie Mac and Fannie Mae, which pass along fees to banks for these particular ranges. The fees ultimately get passed on to the consumer in the form of higher interest rates 740 -850 Credit Score 720-739 Credit Score 680-699 Credit Score 660-679 Credit Score 640-659 Credit Score 620-639 Credit Score < 620 Credit Score A credit score below this range will get you denied for most types of credit. Most creditors will consider your credit ranges a high risk of default. This credit score range typically involves lots of collections, charge offs, slow pays and maybe a public record. If you find a bank willing to lend you money your interest rate will be as high as the law will allow. The bank will try to make as much money as they can incase you default due to your credit risk. Credit Report Statistics The 2 main credit bureaus Experian, and TransUnion currently hold 2002 million credit files. Roughly 172 million of these files contain enough information to generate a credit score. According to U.S. PIRG, 25% of credit reports that they have surveyed contained errors that could result in a credit denial. This survey also showed that 70% of the overall credit reports had errors or some type of mistake on them. |

© 2025 Clover Mortgage Group, L.L.C.

CreditScoreQuick.com 18170 Dallas Parkway Suite 304 Dallas, TX 75287 USA Tel No: 469-438-5587 Toll Free No: 1-800-223-7409 Fax No: 972-767-4370