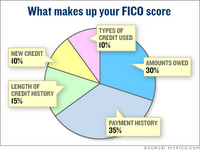

Your credit score or Fico score is the most important element in your financial life these days. Landlords, employers, banks, utility companies and insurance companies all scrutinize your credit score. This credit score is what sums up everything within your credit report. Your credit scores range between 300 to 850.

Yet according to a survey recently revealed, nearly half of Americans have no idea what is on there credit report until it’s too late. According to recent studies people are mis-lead into thinking certain situations determine how high or low a credit score is. Despite all the news media and internet information the fact is the lower your credit score the more you pay. Also in some instances you get that ugly word you were told when you were young, NO. No one likes to be told no, it makes you feel like a child again, even though you are a grown up. If you are applying for mortgage and your credit score is a 610, you could get denied or pay $400.00 dollars a month more because of the risk based pricing now in the banking industry.

While all of this is sinking in, make sure you are not falling for these credit score myths:

Myth 1: Credit Card offers are hurting your credit score. Credit Card offers do not affect your credit score. Now if you respond to the offer the inquiry could lower your credit score. Fair Isaac says that too much credit does not affect your score either, but high credit card balances will lower it.

Myth 2: The higher your salary the higher your credit scores. Paying down credit card debt will lower your credit score. However the amount of money you make, or how much you have in the bank has nothing to do with your FICO score. So in other words your net worth or the amount of money you have coming in is not factored in the credit scoring process according to Fair Isaac the creator of the FICO score.

Myth 3: When you get married your credit scores get merged. When you get married this is simply not true. The only thing that gets merged are accounts you acquire jointly. If you both apply for the same card, then that card and its history shows up on both credit reports.

Myth 4: Shopping around for a loan hurts your score. When you apply for a mortgage, they will pull a recent copy of your credit report which will give a inquiry on your credit report. FICO allows you to shop for a mortgage with multiple lenders with out it hurting your fico score during a 30 window. So during this 30 day window multiple inquiries for a mortgage will only count as one inquiry according to Fair Isaac, MyFICO.

Myth 5: You only have one Credit Score. You have a credit score with each credit bureau. Your credit score could vary as much as 50 points, which is why you need to check your credit score with all 3 credit bureaus.

Myth 6: Checking your own credit report will lower your credit score. This is a question I get all the time. When you are pulling your own credit report it is considered a soft inquiry, which is not factored in the credit scoring process according to MyFICO.

Myth 7: Your age, sex, income are factored in your credit score. According to MyFICO none of this has a factor in your credit scoring process. What the FICO score model is looking for is your credit history with creditors which you owe a debt.

Myth 8: Disputing a item on your credit report will get it removed. This is a common misconception that if you dispute a item it will get it removed. If you dispute a item and you actually owe it, and its reporting within the 7 years required by law, it will not be removed. Now getting inaccuracies removed from you credit report will increases your credit score. Remember collections and charge offs report on your credit report for 7 years from collection date. If you dispute that item during that period, you are wasting your time.

Author: Mike Clover

CreditScoreQuick.com