Archive for the ‘credit report’ Category

Friday, May 30th, 2008

Your credit report is accessible 24/7 on the internet in a few clicks. Equifax just released how the internet is a great resource fore accessing anything about your credit. The internet is amazing in regards to how you can get the information you need to fix just about anything. You can get recipes, commons household items, cars, credit cards, insurance, mortgages, or any common question answered. The internet is so powerful that you could actually stay home and never leave using the internet to buy what you need. Your credit report is accessible 24/7 on the internet in a few clicks. Equifax just released how the internet is a great resource fore accessing anything about your credit. The internet is amazing in regards to how you can get the information you need to fix just about anything. You can get recipes, commons household items, cars, credit cards, insurance, mortgages, or any common question answered. The internet is so powerful that you could actually stay home and never leave using the internet to buy what you need.

The internet being the best channel for credit reports, credit scores and getting free credit repair help, you can rest assure you will have access to what you need securely in a few clicks. If you want to access your credit report, and did it the old fashion way, you would have to wait for your report to come in the mail. I don’t know about you, but I know the mail is not safe anymore. You definitely don’t want anything with your social in the snail mail if you can avoid it. With the security that has been implement on the internet to get your credit report and credit scores safe and securely.

Most people don’t know how convenient the internet is. The internet has revolutionized the way we all do business and function in society currently. Let’s assume you have credit issues, and you don’t know what to do. Most people will search for credit repair sites. You will find that most credit repair sites charge horrendous fees for something you can do yourself for free. If you were to take the time to do some research, you will find that with a little credit education and implementation of what you learn your credit will improve on its own. The internet is just like your local library, it has all the information you could imagine.

How easy is it to get credit report on-line?

Let’s assume you are getting ready to buy something, or just would like to know what your credit scores are. Getting your credit report is so easy that a caveman could do it. Typically when get your credit report you will need to know your credit scores. Your credit scores will typically cost you around $30.00 to have that piece of mind. But it’s worth having believe me. In a matter of a few seconds with validating who you are, you will receive your full 3-1 credit report. Pulling your consumer credit report does not affect your credit scores by the way.

Credit Repair on the web

Let’s assume you have credit issues, and you would like to start repairing them right away. You can find all kinds of articles about what the first step would be in the credit repair process. With your credit being the single most important part of your financial health, you can rest assure the answer is on the web. In a few keystrokes you can be reading an article that will pertain to your situation. This is the power and resourcefulness of the web today. Got questions about credit? Just Google it.

CreditScoreQuick.com

Posted in credit report, fico score, free credit report, free credit score reports | Comments Off

Saturday, May 24th, 2008

Your credit report after a bankruptcy will look like a bomb was dropped on it. Your credit score report will be littered with all kinds of derogatory information. Depending on what type of bankruptcy you filed will determine how long it will take to re-establish your credit. The two most common bankruptcies are Chapter 7 and Chapter 13. With the new bankruptcy law, more people will be forced to file Chapter 13. Here are the differences. Your credit report after a bankruptcy will look like a bomb was dropped on it. Your credit score report will be littered with all kinds of derogatory information. Depending on what type of bankruptcy you filed will determine how long it will take to re-establish your credit. The two most common bankruptcies are Chapter 7 and Chapter 13. With the new bankruptcy law, more people will be forced to file Chapter 13. Here are the differences.

Chapter 7 bankruptcy- is considered liquidation of your non-exempt assets. This bankruptcy is considered the quickest and simplest of all bankruptcies. A court appointed trustee sells off all your assets in an attempt to pay back some of your creditors. During most Chapter 7 bankruptcies the client will not have any assets to liquidate.

Chapter 13 – This bankruptcy is considered a wage earner plan. This plan allows individuals whom have income to develop a plan to pay back there creditors over a 3 to 5 year period. Under this bankruptcy you are assigned a court appointed trustee that you make the agreed upon payments to, which they in return pay your creditors.

Bankruptcy is all too common these days with the economy the way it is. The mortgage crisis and the price of gas have caused many people financial troubles all over the United States. Luckily there is hope after a bankruptcy. It’s kind of like polishing up your shoes after you have got some scuff marks on them. Your credit is the same way, you can re-establish credit after a bankruptcy, and that is the first step once you are done with your bankruptcy.

How to establish credit afterwards

The first step is to get two secured credit cards. No bank is going to allow you to get an un-secured credit card after a bankruptcy. All of your past credit will be on your credit report for 7 years. If you filed chapter 7, it will be on your credit report for 10yrs from file date. But most of your past negative credit will be on your report for 7 yrs. The main objective is to get new credit on your report as soon as possible. The only way to do that is with secured credit cards, and Orchard bank is a great one. FICO likes to see a mix of credit, so make sure you get a couple of secured credit cards. This process will take you at least 12 to 24 months to get your credit scores where they are somewhat decent. After a little time with no slow pays, your creditors will start extending credit to you again.

Don’t be a repeat offender

FICO will forgive you for past bad credit mistakes, but if you are a repeat offender it will be tough to recover. The new FICO scoring process does not want to see you continually having problems. So learn from past mistakes, save your money for hard times and emergencies. Also remember to always stay ontop of your free credit score report.

About the Author: Mike Clover is the owner of http://www.creditscorequick.com/. CreditScoreQuick.com is the one of the most unique on-line resources for free credit score report, fico score, free credit check, identity theft protection, secured credit cards, student credit cards , credit cards, mortgage loans, auto loans, insurance, debt consolidation ,and a BlOG with a wealth of personal credit information. The information within this website is written by professionals that know about credit, and what determines ones credit worthiness.

Posted in bankruptcy, credit report, free credit score reports | Comments Off

Wednesday, May 21st, 2008

When you are looking at your credit report there are weird codes on your credit report only a credit report expert could understand. We found this transunion credit report guide for codes on your credit report and what they represent. This guide was created in 2003 for mortgage brokers. I believe a credit geeks would appreciate trying to decipher credit report code.

Type of Account

O Automated

R Revolving or Option

I Installment

M Mortgage

C Check Credit (line of credit)

Date Indicators

A Automated

C Closed

D Declined

F Repossessed / Written / Off / Collection

I Indirect

M Manually Frozen

N No Record

P Paid Out

R Reported

S Slow Answering

T Temporarily Frozen

V Verified

X No Reply

(KOB) Kind of Business Classifications

A Automotive

B Banks and S&L

C Clothing

D Department, Variety and other Retail

E Employment

F Finance, Personal

G Groceries

H Home Furnishings

I Insurance

J Jewelry, Cameras and Computers

K Contractors

L Lumber, Building Material, Hardware

M Medical and related Health

N Credit Card and Travel/Entertainment Companies

O Oil Companies

P Personal Services Other Than Medical

Q Finance Companies, Other than Personal Finance Companies

R Real Estate and Public Accommodations

S Sporting Goods

T Farm and Garden Supplies

U Utilities and Fuel

V Goverment

W Wholesale

X Advertising

Y Collection

Z Miscellaneous

Here is a link to this document that list special codes and triggers that may be on a TransUnion credit report.

About the Author: Mike Clover is the owner of http://www.creditscorequick.com/. CreditScoreQuick.com is the one of the most unique on-line resources for free credit score report, fico score, free credit check, identity theft protection, secured credit cards, student credit cards , credit cards, mortgage loans, auto loans, insurance, debt consolidation ,and a BlOG with a wealth of personal credit information. The information within this website is written by professionals that know about credit, and what determines ones credit worthiness.

Posted in credit report, free credit score reports | Comments Off

Tuesday, April 29th, 2008

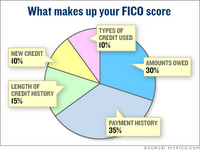

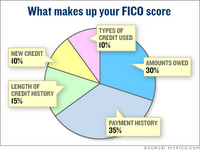

Fico scores are calculated from different data within your credit report. This information is grouped into five categories. The Chart below will reflect this as well as the percentage of importance for each category.

These percentages of these categories are for the purpose of the general population. For example someone that is new to the credit scène these percentages may not apply.

Payment History

• Number of accounts paid as agreed

• Presence of negative Public Records(Judgments, bankruptcy, suits, liens, wage attachments, etc ( Collections, and/or delinquency(past due items)

• Severity of delinquency( how long past due)

• Amount past due on delinquent accounts or collection accounts

• How much you’re past due on accounts or collections.

• How many collections you have

• Account payment information on particular accounts (installment loans, credit cards, retail accounts, finance company accounts, car notes, mortgage, etc…)

Length of Credit History

• Time since account activity

• Time since accounts opened

• Time since account opended, by type of account

New Credit

• Time since account was open, by credit type

• Time since credit inquiry

• Number of recently opened accounts, and proportion of accounts recently opened by account type.

• Re-establishment of credit after recent credit problems

• Number of recent credit inquiries

Amounts Owed

• Proportion of installment loans still owed, proportion of balances to original loan amount on certain installment loans

• Number of accounts with balances

• Amounts owed on specific types of accounts

• Amount owed on accounts

• Lack of specific types of credit balances

• Proportion of credit lines used (proportion of balances to total credit limit on certain types of revolving accounts

Types of credit used

• Number of (prevalence, presence, and recent information on ( different account types such as credit cards, retail accounts, mortgage, installment loans, and consumer finance accounts.

*Please take note

Your FICO score takes into consideration of all these variables discussed.

No one piece of information or factor will determine your score alone.

The importance of any factor depends on your over all credit history.

It is really hard to single out any other factor over another, since all factors take part in the overall scoring process. What is important is the mix of information being reported within your credit report.

Your FICO score only looks at information within your credit report. However lenders look at other information outside this report to also make a credit decision.

Example:

• Work History

• Salary

• Rental History

• Kind of credit you are requesting

Your score considers both negative and positive information on your credit report. Late payments will lower your credit score, but establishing or re-establishing a good payment history will increase your credit score.

CreditScoreQuick.com

Posted in annualcreditreport, credit report, fico score, free credit check, free credit score reports | Comments Off

Friday, March 28th, 2008

A credit inquiry is an item on your credit report that shows with permission a creditor requested your free credit report.

Not all credit inquiries affect your credit score:

You may notice when you pull your credit report there are inquiries on there from a business you are not familiar with. The only inquiry that affects your credit score is the one where you are applying for credit. This is considered a hard pull on your report.

Inquiries that affect your credit score:

There is only one type of inquiry that affects your credit score. This type of inquiry is applications for a mortgage, auto loan and other credit, by you authorizing these creditors to access your credit report. This type of inquiry prompted by your own actions ends up on your personal credit report and affects your score.

An inquiry that does not affect your credit score:

Checking your own personal credit report or any business that offers goods and services that requests your report. A business that you already have a account with that requests a check. A potential employer that does credit checks. Some of these types of inquiries might show up on your report but do not affect your credit score.

Checking your credit report does not affect your Credit Score:

Checking your credit report on a regular basis to ensure it is accurate and error free is recommended by Fair Isaac the inventor of the FICO Score. Maintaining a error free credit report is part of credit management which will improve your credit rating over time. Ordering your credit report at CreditScoreQuick.com does not hurt your credit score.

How credit inquiries are factored in your Credit Score:

There are five types of information used to calculate your credit score. Each category accounts towards a percentage of your score.

Payment History – 35%

Amounts Owed – 30%

Length of Credit History – 15%

Types of Credit in use – 10%

New Credit – 10%

Don’t let inquires scare you. There is nothing wrong with shopping for a better rate, or better terms on a loan. As you can see in the about chart, payment history is the biggest factor in calculation process of your credit score. The second biggest factor is how much of your approved credit limits are charged up. But of course you don’t want to go out and start applying for every credit offer out there either. Be responsible and have a good mix of credit, but stay away from too much credit as well You really on need 3 lines of credit reporting on your credit report.

Example:

1. credit card

2. car note

3. installment loan

This type of credit mix accounts for 10% of your score.

CreditScoreQuick.com

Posted in credit report, free credit report, free credit score reports | 2 Comments »

Saturday, March 22nd, 2008

Did you think checking your credit report was not necessary? I would think again, recent studies show most employers are checking your credit as part of the decision process. They are looking into your personal history is to see if you are responsible enough to hold a job. Companies don’t want to hire someone that is financially tapped out; someone that is in this situation might be desperate and attempt to steal. Did you think checking your credit report was not necessary? I would think again, recent studies show most employers are checking your credit as part of the decision process. They are looking into your personal history is to see if you are responsible enough to hold a job. Companies don’t want to hire someone that is financially tapped out; someone that is in this situation might be desperate and attempt to steal.

Jobs that involve money handling

A position that involves an employee handling money will typically require a credit report check. These companies do a background check as well. If a company is hiring you to handle there money, they want to make sure you are very responsible. There are accounts where potential employee applied for a position with a company as was denied employment due to bad credit. If you think your credit report is littered with collections, charge offs and late payments you might want to work on cleaning those types of issues up. This type of activity whether it’s a professional job or a cashier job could cost you a potential opportunity.

Government Jobs

When the government looks into hiring an individual they pull your credit report. They want to make sure you are not a security risk. They also pull your credit after you have been hired. Judy Langley was hired at by the “City of Dallas” for a clerical position. The requirement was once she was hired she had to improve her credit. The city hiring manager knew she had some credit issues, and required that she improve her credit over a 12 month period. In other words if you have past credit issues, your new employer could require you to clean it up.

Your Rights under the Fair Credit Reporting Act (FCRA)

The FCRA requires written consent on your behalf before an employer can pull your personal credit score report and/ or background check. Nether less if you suspect you have credit issues, and you are in the market to find that dream job you might want to pull a recent copy of your report with scores. Everyone looks at your credit scores as well. When an employer uses your credit report as part of the hiring process, they are suppose to inform you of this. If they deny you employment due to your credit, they are supposed to do two things:

* The employer is supposed to give you a copy of your credit report and give you your rights under the FCRA.

*The employer is also to disclose which company gave the information so they can dispute any information that might be inaccurate.

Rather than go through all of this they will simply say you were denied for other reasons.

Find out what’s on your record

This is why it’s so important to pull your credit report regularly, so if you have to get a new job or your current employer is doing credit checks, you don’t want to have issues due to bad credit decisions.

CreditScoreQuick.com

Posted in credit report, fix credit, free credit score reports | Comments Off

Wednesday, March 19th, 2008

A credit score is a number that reflects your creditworthiness at any given time. Typically the higher your score the better your credit. Individuals with higher credit scores typically can obtain mortgages, credit cards, loans and insurance with better terms. The lower your score the worse your terms are on any offer. The Credit Score is based on the information stored with in your credit report.

Each Bureau has its own score

Each Bureau has its own name for the FICO® Score.

Equifax – Beacon

TransUnion – FICO Classic

Experian – FICO Risk Model

The general scoring ranges between 300 – 850. Fair Isaac divides the scores into five categories.

780 – 850 – Low Risk

740 – 780 – Medium – Low Risk

689 – 740 Medium Risk

620 – 690 – Medium High Risk

620 – and Below – High Risk or “sub-prime.”

A credit score can change quickly for several reasons, including late payment or big increases in credit card balances. Each credit bureau may not have identical information about you, in large part because some creditors only report to one or two bureaus instead of all 3. This results in different credit scores amongst the credit bureaus. Some insurers and creditors use there own formula to calculate score in conjunction with the FICO score model. For example one lender might emphasize more on payment history within the credit report, where another lender might focus on something totally different within your report. A credit score itself might be the determining factor of better rates and terms with other creditors. But in the insurance context, the “credit-based insurance score, “typically is on of the many factors determining whether a policy is underwritten or at what premium. Most lenders and insurance companies scan your credit report for derogatory terms like bankruptcy, judgments, foreclosures, and collections.

How is a credit score calculated?

Factor 1: Payment History (35%)

Factor 2: Amount Owed – Extent of Indebtedness (30%)

Factor 3: Length of Credit History – The Longer, The Better (15%)

Factor 4: How Much New Credit? (10%)

Factor 5: Type of Credit (10%)

CreditScoreQuick.com

Posted in FICO, credit report, free credit report, free credit score reports | Comments Off

Monday, March 17th, 2008

Foreclosure is a common subject these days, but there is life after having one. If you have recently had a foreclosure on your credit report, you will be able to recover from this bad experience. Fair Isaac with its new FICO 08 with due time will forgive you for a foreclosure as long as you are not a repeat offender. This new calculated risk software understands that unfortunate situations come up in ones life, but don’t make the same mistake again. Definitely don’t make it a habit of having credit problems is the point. Foreclosure is a common subject these days, but there is life after having one. If you have recently had a foreclosure on your credit report, you will be able to recover from this bad experience. Fair Isaac with its new FICO 08 with due time will forgive you for a foreclosure as long as you are not a repeat offender. This new calculated risk software understands that unfortunate situations come up in ones life, but don’t make the same mistake again. Definitely don’t make it a habit of having credit problems is the point.

How long will it take before you can buy again?

Your credit report might recover quickly as long as you have other good standing credit reporting on your credit report. But that does not mean you can buy a home right a way. Most people that have foreclosures usually take time to recover from such a bad experience. HUD knows this, and that is why you cannot get a FHA loan for a minimum of three years from foreclosure date. It’s almost impossible to get a Conventional loan, because conventional loans are automated approvals. Typically with a foreclosure, collections or low scores this automated software will deny you. FHA is a different type loan all together, since it’s a government insured loan you can get what they call a manual underwrite for this type of loan. What this means is if the automated process through Freddie Mac or Fannie Mae says no, you can get an underwriter to manually approve the loan. So you can expect to wait at least a minimum of 3 years after foreclosure date before you can begin to think about financing a home again.

Pay everything on-time

When a bank lends you money, it’s a big risk. Banks don’t want to lend money to someone that has total disregard for their credit. If you have had a recent foreclosure the last thing you want to do is have late payments, collections or any other negative information hit your credit report. Let’s face it, the whole reason banks, mortgage companies, car dealers, landlords, and employers pull your credit report is to see if you pay your debts. I personally would not lend to someone that did not pay their bills back, would you? With the recent tightening up in the lending arena you might want really work on increasing your credit score. Also make sure you have at least 3 lines of credit reporting on your report. If you had to let everything go, you might consider getting a secured credit card. This type of card will help you re-establish your credit.

Save Money

Saving money is very important when it comes to getting a loan. Lenders like to see you saving money because it shows stability. Let’s assume you loose your job, well if you have 6 months payments in the bank you are less likely to let your house go. If a emergency comes up you have some money in the bank to assist in some way. Saving money also shows you are responsible as well. Let’s say two people go to the bank to get a loan and they both have bad credit. The main difference between the two bad credit borrowers is one has $5000.00 in the bank. Who do you think the bank is more likely to approve? These are some key point I wanted to touch on to revive your credit after a foreclosure. There is life after so make sure you manage your credit report and credit scores so you can begin home ownership soon.

CreditScoreQuick.com

Posted in credit report, fix credit, foreclosure, free credit report, free credit score reports | 2 Comments »

Wednesday, March 12th, 2008

Your credit score in 2008 is very important when it comes to buying a house. Heck your credit score is important when it comes to getting a loan period these days. Since the sub-prime mortgage meltdown, Wall Street has tightened up on what kinds of mortgage paper they will buy. Most loans are run through automated underwriting engines. The underwriting engine will either say yes or no, but here is the funny thing. Even though the engine says yes, the investor may have its own internal guidelines that would overrule an automated approval. This is not normal in the loan business. During the past years when you got an automated approval with either Freddie Mac or Fannie Mae underwriting engines you were golden.

Mortgage Insurance Companies

Since all the tightening up in the lending industry, the companies that insure these loans have tightened up as well. The reason for this is all the claims that are being filed as a result of defaults on mortgage loans. I have discussed in other articles how everything basically is based on risk, well so is insurance. If the insurance company sees a pattern with certain credit scores and loan types they will tighten up on the underwriting guidelines for those specific borrowers. Currently you cannot get a 100% Conventional prime loan unless you have a 680 credit score. Previously it was below 600 credit scores, but you had a higher interest rate. Currently they will just deny you of the loan, because they cannot get the loan insured. This mortgage crisis will affect everyone, including people with good credit. They will be able to get loans, but the loan guidelines will be more stringent.

FHA loans

FHA loans have been around since 1935. This government entity is the single largest insurer of loans in the world. FHA has baled the housing industry out of the tar pit right after the great depression. It looks like the same savior will be at it again in 2008. FHA loans have not tightened up, but again the investors that buy this paper have. Its common for banks to sell there loans to other banks. This is just a common practice these days. The only problem is the big banks buying paper from the small banks have really tightened up on what type of loans they will buy. With this being said, the entire process is getting tough all around.

Credit Scores

Your credit scores will either make you or break you when it comes to getting credit extended to you. With the disaster in the housing market, you can count on it getting even tougher with credit score requirements. So if you are in the market to get a home, I would recommend getting a copy of your free credit score report and see where your scores stand. Your score will be extremely important in this current lending market.

Posted in credit report, credit worthy, free credit score reports | Comments Off

Thursday, January 31st, 2008

Your credit score could be affected by little mistakes made on your part. These mistakes are made all the time, and most don’t realize the impact on your credit report and credit score. We have seen these common problems quite often, even though you are providing help for a family member or friend.

Co-signing for loans:

One of the most common credit mistake is co-signing on a loan for friends and family members that don’t pay there bills. Yes you thought you were helping someone out, but in return hurt your personal credit. Over the years we have seen more and more people helping out other people with loans, and there credit report is littered with late payments. The result is sorry we cannot help you with the loan you are applying for because your credit score is too low. Late payments will drop your credit score 100 points. So if you had a 700 FICO score, now you have a 600 FICO score. So don’t co-sign for someone else. They need to learn how to establish credit on there own.

Closing Credit Card Accounts:

Fair Isaac Corporation does not recommend closing out credit cards, especially if the card is in good standing. Once you close out a card that is a good revolving line of credit, you just dropped your scores. This credit was reporting in good standing with a credit limit, the credit limit is a part of your credit score. So if you close it, you score will drop due to good credit being removed.

No Credit Cards will hurt your Score:

If you thought it was ok to avoid having credit cards you are wrong. Fair Isaac recommends having credit cards, but use them responsibly.

High Credit Card Balances:

High credit card balances will lower your credit score as well. According to Fair Isaac your balance should not be more than 30% of credit limit. The lower your balance is the higher your credit score will be. This is the quickest way to increase your credit scores.

Don’t give up:

Maybe you have made some mistakes, and now you are on the road to recovery. Remember your credit is just a snapshot of your credit during a particular time. You can always improve your credit by paying down your balances, and being on-time with your payments to creditors.

CreditScoreQuick.com

Posted in bad credit, credit education, credit repair company, credit report, free credit score reports | 1 Comment »

Disclaimer: This information has been compiled and provided by CreditScoreQuick.com as an informational service to the public. While our goal is to provide information that will help consumers to manage their credit and debt, this information should not be considered legal advice. Such advice must be specific to the various circumstances of each person's situation, and the general information provided on these pages should not be used as a substitute for the advice of competent legal counsel.

|

Your credit report is accessible 24/7 on the internet in a few clicks. Equifax just released how the internet is a great resource fore accessing anything about your credit. The internet is amazing in regards to how you can get the information you need to fix just about anything. You can get recipes, commons household items, cars, credit cards, insurance, mortgages, or any common question answered. The internet is so powerful that you could actually stay home and never leave using the internet to buy what you need.

Your credit report is accessible 24/7 on the internet in a few clicks. Equifax just released how the internet is a great resource fore accessing anything about your credit. The internet is amazing in regards to how you can get the information you need to fix just about anything. You can get recipes, commons household items, cars, credit cards, insurance, mortgages, or any common question answered. The internet is so powerful that you could actually stay home and never leave using the internet to buy what you need.